Cost of crony capitalism in the United States

| This is a research project at Wikiversity. |

This article suggests that crony capitalism costs the median American family $39,000 per year, roughly $100 per day, in lost income from what their income would be if the benefits of productivity improvements from 1970 to 2010 had been broadly shared, as they were from 1947 to 1970. This number is based on the difference in the growth in mean and median family incomes over the past 40 years. Paul Buchheit produced a different estimate: He estimated that the average American family pays $6,000 per year in direct subsidies.[1]

The difference, $33,000 per year, is more hidden. These hidden subsidies include numerous government decisions that allowed mergers and acquisitions that reduced competition in violation of U.S. antitrust law. It also includes the failure of consumers to properly seek the information they need to become more intelligent consumers. An example of the latter is the fact that the finance industry in the U.S. has since 2000 captured roughly a third of U.S. domestic corporate profits.

Growth in income inequality

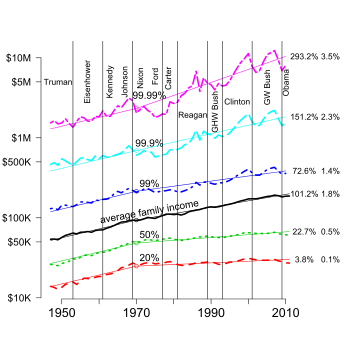

editThe accompanying figure shows the evolution from 1947 to 2010 of the income distribution in the US. The solid black line in the middle is the average family income [Gross domestic product (GDP) per household adjusted for inflation]: It increased at roughly 2.2 percent per year from 1947 to 1970 and at roughly 1.8 percent since. The increase at 1.8 percent per year accumulates to 101.2 percent over the 40 years between 1970 and 2010. In other words, the US economy today produces double the goods and service per person as it did 40 years ago.

Most though not all of this doubling in average annual income in the US has come from productivity increases -- producing more goods and services with less through the adoption of more efficient work methods. Alperovitz claims that when productivity doubles, the benefits could be distributed in different ways such as lowering the work week. Instead, between 1970 to 2010, the number of hours worked per week in the US has increased slightly after falling dramatically from roughly 70 hours in 1850 to 60 in 1900 to 50 in 1920 to just a little over 40 since 1950. In Europe, by contrast, the work week continued to fall throughout the last century; the official work week in France is now 35 hours. Workers in Europe also have more holidays and vacation time than in the US.[5]

The other lines in the accompanying figure give the 20th, 50th, 99th, 99.9th, and 99.99th percentiles of the distribution. Thus, 20 percent of American families have had annual incomes less than the bottom line in this plot; 99.99 percent have had annual incomes less than the top line.

The key feature of this plot is what happened to the income distribution over this period: If the lines have essentially the same slope, the benefits of productivity improvements are broadly shared. This is true of the growth from 1947 to 1970. However, since 1970, the lines have diverged, indicating that most of the benefits of productivity growth have gone to those better off.

In particular, the median family income (with half the population below and half above) grew by only 22.7 percent 1970 - 2010, while the average grew by 101.2 percent. Even the 99th percentile lost ground relative to the broadly shared growth of 1947-1970, increasing only 72.6 percent. For the median American family, the difference between the 101.2 percent growth of the average and the 22.7 percent growth of the median (87.5 percent) amounts to roughly $39,000 per year ($106 per day). In other words, if the economic growth over the past 40 years had been equitable distributed as it was 1947-1970, the typical (median) American family would have $100 per day more income than they actually do.

The evolution of top income shares in the US, the UK, Canada, France, Japan and Switzerland were compared by Piketty and Saez.[6] During World War II (1938 - 1946) the share of income garnered by the top earners (top 1 percent or 0.1 percent) fell dramatically in all the countries at war. (Switzerland was officially neutral in the war, and their wealthy did not lose income share.) The top earners' share started rebounding in the 1970s in the US and to a lesser extent in the 1980s in Canada and the UK. They had not started to rebound in France and Japan by 2000, the end of this study period. Piketty and Saez offer two competing theories for this. First, "impediments to free markets due to labor market regulations, unions, or social norms ... can keep executive pay below market." Second, "the increased ability of executives [in the US] to set their own pay and extract rents at the expense of shareholders." The "impediments" theory could apply to explain the broadly shared growth from 1947 to 1970, while the "executives" argument could explain the the divergence since then. Another factor could be the increased ability of big money interests to get special favors from government.

There seems little doubt that governmental action can increase or stifle economic growth and can influence the distribution of the benefits of that growth. It is important therefore to consider whether there is a relationship between economic growth and income inequality. Piketty and Saez note that any relationship is not simple. The US had the fastest rate of economic growth in the 1980s and 1990s, which offers some support for the claim that increasing executive compensation has increased the growth rate. However, that assertion is challenged by the fact that in the post-World War II period, the former combatants all had respectable economic growth rates.

More generally, we'd like to understand what factors determine the rate of economic growth and how the benefits are distributed.

Other sources

editBuchheit

editPaul Buchheit identified seven different types of subsidies big business receive at the expense of consumers:[1]

| amount | description | source | |

|---|---|---|---|

| 1 | $870 | Direct Subsidies and Grants to Companies | Cato Institute[7] |

| 2 | $696 | Business Incentives at the State, County, and City Levels | New York Times[8] |

| 3 | $722 | Interest Rate Subsidies for Banks | Huffington Post[9] |

| 4 | $350 | Retirement Fund Bank Fees | Demos[10] |

| 5 | $1,268 | Overpriced Medications | Center for Economic and Policy Research[11] |

| 6 | $870 | Corporate Tax Subsidies | Tax Foundation[12] |

| 7 | $1,231 | Revenue Losses from Corporate Tax Havens | U.S. Public Interest Research Group[13] |

| total | $6,007 |

Buchheit and Roberts

editBuchheit claims that these figures are conservative. For example, the first item, $870 per family according to the Cato Institute, 'includes fossil fuel subsidies, which could be anywhere from $10 billion to $41 billion per year for research and development. Yet this may be substantially underestimated. The IMF (International Monetary Fund reports U.S. fossil fuel subsidies of $502 billion, which would be almost $4,400 per U.S. family by taking into account "the effects of energy consumption on global warming [and] on public health through the adverse effects on local pollution." According to Grist, even this is an underestimate.'[1]

David Roberts at Grist provided a more detailed summary of that IMF study. It included the $502 billion just mentioned as part of a $1.9 trillion estimate of global subsidies to fossil fuels. A good portion of the difference, $1.4 trillion, assumes a "social cost of carbon (SCC)" of $25 per ton. The SCC is still hotly debated. However, it's clear to nearly everyone except climate change deniers that the SCC is real and not negligible. Roberts cites a peer-reviewed publication claiming the SCC could be 12 times higher, $300 per ton. The British government estimated the SCC at $83 per ton. This latter number would make "the grand total of annual global fossil fuel subsidies ... rise from $1.9 trillion to around $3.5 trillion."

These environmental damages are real and coming, but we don't yet have good estimates of them. However, as Roberts notes, "by failing to make fossil fuel companies pay for them [or otherwise internalize these costs into the price customers pay], governments are implicitly subsidizing those companies." They make more environmentally friendly sources of energy less competitive in the market and push consumers to do things that have potential catastrophic impacts on the entire world.[14]

Two points here:

- Buchheit's $6,000 per year per family is still conservative.

- The astronomical social cost of carbon (SCC) is NOT included in the $39,000 discussed above for annual income lost by the median American family over the past 40 years.

A companion analysis of the Finance industry in the United States estimates a return of roughly $80 billion per year on $500 million invested by that industry in lobbying and political campaign contributions. That's $160 return on each dollar so invested.

To compare this with the Buchheit analysis above, we note that the US includes roughly 120 million households. Dividing $80 billion by 120 million gives us $667 dollars per household per year. This is 62 percent of the $1,072 (= $722 + $350) in items 3 and 4 above. However, the analysis of the Finance industry in the United States just mentioned was quite rough, and the $1,072 is probably more accurate.

What's the difference?

editThe difference between the $39,000 per year estimated from the increase in income inequality over the past 40 years and Buchheit's $6,000 is $33,000. What political economic forces have created this difference? One primary candidate is market failures discussed in the article on documenting crony capitalism. This analysis considers both legitimate and illegitimate economies of scale. Legitimate economies of scale result from higher volumes that allow larger investments, which in turn drive per unit costs. Illegitimate economies of scale include favors from government such as support for mergers and acquisitions that lessen competition and allow big businesses to charge higher prices than they could in more competitive markets.

References

edit- Alperovitz, Gar (2011). America beyond Capitalism: Reclaiming our wealth, our liberty, and our democracy. Democracy Collaborative Press. ISBN 978-0-98478570-4.

- Buchheit, Paul (September 23, 2013), "Add It Up: The Average American Family Pays $6,000 a Year in Subsidies to Big Business", Common Dreams, retrieved October 1, 2013

Notes

edit- ↑ 1.0 1.1 1.2 Buchheit (2013)

- ↑ Table F-1. Income Limits for Each Fifth and Top 5 Percent of Families (All Races): 1947 to 2010, Current Population Survey, Annual Social and Economic Supplements, United States Census Bureau, retrieved 2012-01-24 (median computed as the geometric mean of the 20th and 40th percentiles)

- ↑ Piketty, Thomas; Saez, Emmanuel, Atkinson, A. B.; Piketty, Thomas (eds.), Income Inequality in the United States, 1913-2002, retrieved 2012-02-08

{{citation}}: Unknown parameter|booktitle=ignored (help) - ↑ The differences between the Census and Internal Revenue Service Data can be seen most easily in the 95th percentile, present in both data sets. For more details see the help file for the "incomeInequality" data in the Ecdat package available from the Comprehensive R Archive Network (CRAN; see r-project.org).

- ↑ Alperovitz (2011, ch. 17, pp. 197-198)

- ↑ Piketty, Thomas; Saez, Emmanuel (2006). "The Evolution of Top Incomes: A Historical and International Perspective". American Economic Review, Papers and Proceedings 96 (2): 200-2005. http://elsa.berkeley.edu/~saez/piketty-saezAEAPP06.pdf. Retrieved February 14, 2013.

- ↑ DeHaven, Tad (July 25, 2012), Corporate Welfare in the Federal Budget, Policy Analysis, Cato Institute, retrieved October 1, 2013

- ↑ Story, Louise; Fehr, Tiff; Watkins, Derek (2012), "United States of Subsidies: Explore the data", New York Times

- ↑ "U.S. Government Essentially Gives The Banks 3 Cents Of Every Tax Dollar", Huffington Post, February 21, 2013

- ↑ Hiltonsmith, Robert (May 29, 2012), "The Retirement Savings Drain: Hidden & Excessive Costs of 401(k)s", Demos, retrieved October 1, 2013

- ↑ Baker, Dean (August 19, 2012), Washington Post and Kaiser Conceal Role of Government In Economy, Beat the Press, Center for Economic and Policy Research

- ↑ Buchheit (2013) includes this item with a broken link to the Tax Foundation. He also provides another link to Citizens for Tax Justice with a comparable number that is almost $1,600 per family per year.

- ↑ Offshore tax havens cost average taxpayer $1,026 a year, small businesses $3,067, U.S. PIRG, April 4, 2013, retrieved October 1, 2013

- ↑ Roberts, David (March 28, 2013), "IMF says global subsidies to fossil fuels amount to $1.9 trillion a year … and that's probably an underestimate", Grist, retrieved October 6, 2013